How much can i borrow on 60k salary

For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. Lowest Home Financing Rates Compared Reviewed.

How Much Money Do Real Estate Agents Make Each Year

It depends on your debt service payments not just your income.

. For this reason our calculator uses your. Get Instantly Matched with the Best Personal Loan Option for You. Your salary will have a big impact on the amount you can borrow for a mortgage.

Compare Mortgage Options Get Quotes. Australia Salary Tax Calculation - Tax Year 2022 - 6000000 Annual Salary. Ad Get The Service You Deserve With The Mortgage Lender You Trust.

If you already have 50K then take that off. After all in our earlier example if we extend the term from 48 to 72 months the monthly payment drops to just 17523. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You.

No Credit Harm to Apply. Skip the Bank Save. Were not including any expenses in estimating the income you.

Get Your Estimate Today. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. Mortgages are typically available for two to 25 times your yearly salary according to the conventional wisdom.

Apply Today Enjoy Great Terms. Its how big your. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

How much house you can afford is also dependent on. By Fraser Sherman Updated December 15 2018 The usual rule of thumb is that you can afford a mortgage two to 25 times your annual income. Thats a mortgage of 120000 to 150000 at a rate of 60000.

Ad Get The Service You Deserve With The Mortgage Lender You Trust. Typically lenders will determine how much you can borrow by multiplying your salary by four and a half or five times. A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

Your annual income before tax Salary 000. 40k to 49k per year If you want to buy a. Compare Mortgage Options Get Quotes.

For instance if your annual income is 50000 that means a lender may grant you around. The table below shows example calculations for maximum borrowing based on salaries between 35000 and 39000 per year. Thats ignoring how much you have saved for a deposit.

Income Is A Significant Part Of Deciding How Much You Could Borrow Income is crucial for determining how big a mortgage you can have. Thats a 120000 to 150000. Best Loans of 2022.

Borrowers typically save a 10 or 20 deposit. Get Your Estimate Today. How much can I afford to borrow based on my deposit.

Low APR from 399. The smaller your deposit the more you have to borrow. Get Started Now With Quicken Loans.

Click Now Apply Online. Check Your Eligibility and Connect With Our VA Loan Team for a Free Consultation Today. So on your 60K salary you can take on a mortgage of 240-360K.

Generally lend between 3 to 45 times an individuals annual income. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. Ad Get Personal Attention and Support From a Leader in Government-Backed Mortgage Lending.

Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. Ad Best Personal Loans of 2022. Get Started Now With Quicken Loans.

Variable you would make 180 monthly payments of 49913 and pay 8984340 overall which includes interest of. Best 60000 Loan Rates Reliable Comparison Reviews Best Rates Quick Approval. Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

If you borrowed 46000 over a 15-year term at 840 pa. But pushing out your loan term means you pay much. Apply Easily Get Pre Approved In 24hrs.

Factors that impact affordability. Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances 5 Deposit Calculation for a. So for example if you had an annual salary of 200000.

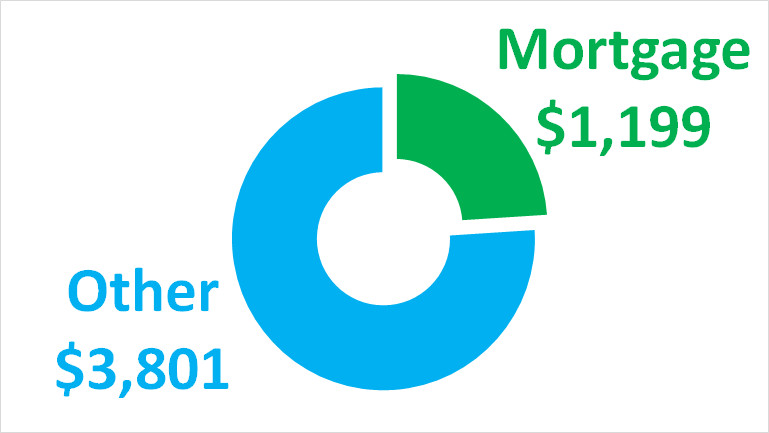

Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend you based on your income and expenditure. How much of a home loan can I get on a 60000 salary. When it comes to calculating affordability your income debts and down payment are primary factors.

Ad Low Interest Loans. Mortgage lenders in the UK. You also have to be able to afford the monthly.

Ad Highest Satisfaction For Home Financing Origination. Employer Superanuation for 2022 is payable on all employee earning whose monthly income exceeds.

What Kind Of House Can I Afford Making 60k

How Much Mortgage Can I Afford If My Income Is 60 000

How Much Can I Borrow On A Mortgage Based On My Salary

How Many Times My Salary Can I Borrow Mortgage Yescando

60 000 A Year Is How Much An Hour 2022 Guide Savvy Budget Boss

Why Households Need 300 000 To Live A Middle Class Lifestyle

1

1

I Make 60 000 A Year How Much House Can I Afford Bundle

Mtidavis How Much Can I Borrow If I Earn 60000

How Much House Can I Afford Calculator Money

My Income Is 60k How Much Mortgage Can I Qualify For Quora

How Much Can I Borrow Depending On My Deposit Mozo

How Much Could I Borrow For A Mortgage Br

How Much Can I Borrow Home Loan Calculator

Is 60k A Year A High Salary In The U S Quora

Is 60k A Year A High Salary In The U S Quora